Scheinselbständigkeit: What it is, and how to avoid it

Freelancing has become increasingly popular in the last few years, with employees from all fields and industries opting to go freelance instead of sticking to more traditional forms of employment. This has also been labelled as the “rise of the gig economy” by some. What it ultimately means is that people are striving for more independence and self-determination in their professional lives.

Perhaps you are looking to take advantage of the growing market and to hire a freelancer. Or you are exploring the possibility of going freelance yourself – there are many potential benefits after all. One key element to successful freelancing are the relationships between clients and freelancers. But as you cultivate those relationships, it is important to not fall into the trap of Scheinselbständigkeit.

What is Scheinselbständigkeit?

Translated into English this simply means false self-employment. It is usually applied to those who formally classify themselves as freelancers despite having a subordinate and employee-like relationship to their clients. This might manifest in any number of ways: having to participate in company meetings or performance reviews, having the client dictate your work hours, or having to work on site with materials provided by the client.

Being a freelancer means to be an independent unit of business; you are responsible for the acquisition of new clients, working independently and outside of the corporate structures of clients.

But false self-employment, or the german equivalent of Scheinselbständigkeit are not just colloquial terms – they are also legal concepts. Despite their fees often being higher, businesses might consider a freelancer to be cheaper to deal with than a permanent employee –they are not entitled to any benefits by the company, nor are their working rights safeguarded. This misclassification also has consequences for taxation and insurance, as freelancers are responsible for covering their obligations to the state themselves.

There are a variety of regulatory bodies in Germany which may investigate such false self-employment, such as the tax office, labour courts or the pension insurance association. If such an investigation finds evidence of Scheinselbständigkeit, the employer usually must retroactively pay any contributions they should have made on behalf of the employee. In particularly grievous cases, or where the investigators determine deliberate intent to defraud, there may be significant fines or even a prison sentence.

How to identify true self-employment

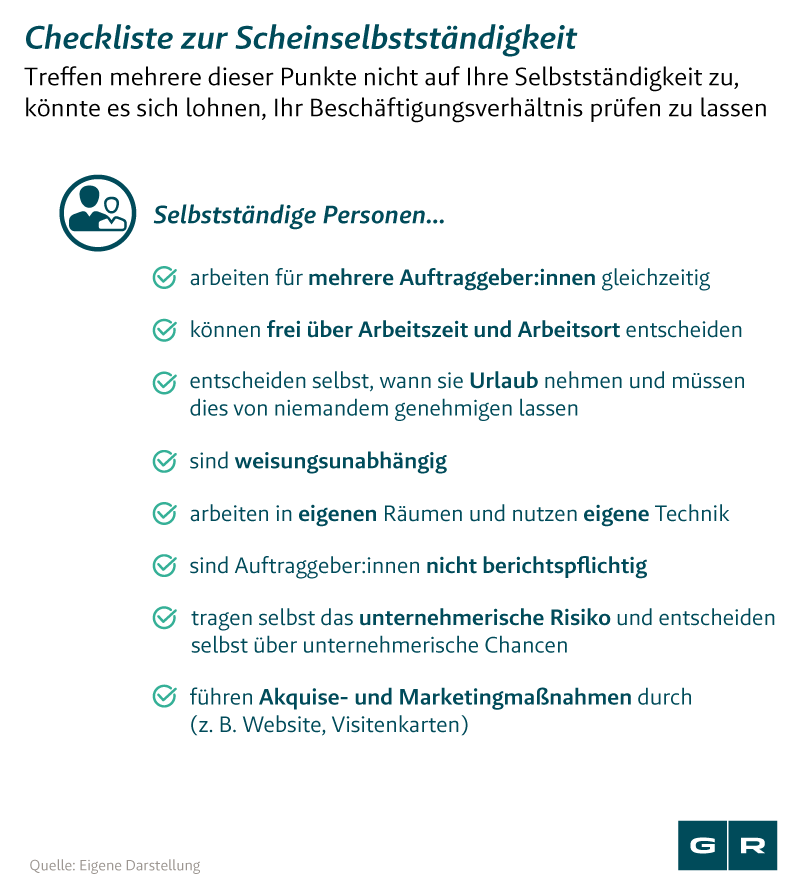

Most commonly this misclassification is simply a result of confusion and lacking transparency regarding working agreements and legal categories. To combat this there are many resources online, often in the form of checklists, designed to help freelancers assess whether they are truly self-employed.

These checklists often place emphasis on your business relationship to your client. Common questions include whether you have multiple clients as sources of income, and have the power to structure your work time, or to even decline working on a project.

Another term that pops up in these lists is weisungsunabhängig, which means to be independent in how and when you work, rather than being bound to instructions from a manager. Do you appear as an individual entity rather than a part of the business? Do you have to report back to the company, are expected to participate in internal meetings, or have any decision-making power?

One method of avoiding this quasi-self-employment and maintaining your independence as a business, is to carefully read your agreements with clients. They should allow you full self-determination and be focused on the delivery of results rather than seeking to structure the process. Beyond that its important to not grow complacent – keep working for and seeking out new clients, rather than restricting your work to only one client.

If you are interested in reading more about Scheinselbständigkeit, or want to explore some of these checklists, feel free to explore the resources portion of the article.

(Re-)Sources

Falsely self-employed? Here’s everything you need to know – IONOS

How to avoid false self-employment in Germany | Accountable

Scheinselbstständigkeit | Definition, Checkliste & Strafen

Scheinselbstständigkeit vermeiden mit diesen Tips | Personio

So umgehst du die Scheinselbstständigkeit – Die besten Tips & Tricks

The Ultimate Guide to False Self-Employment [+ Checklist] | ElevateX